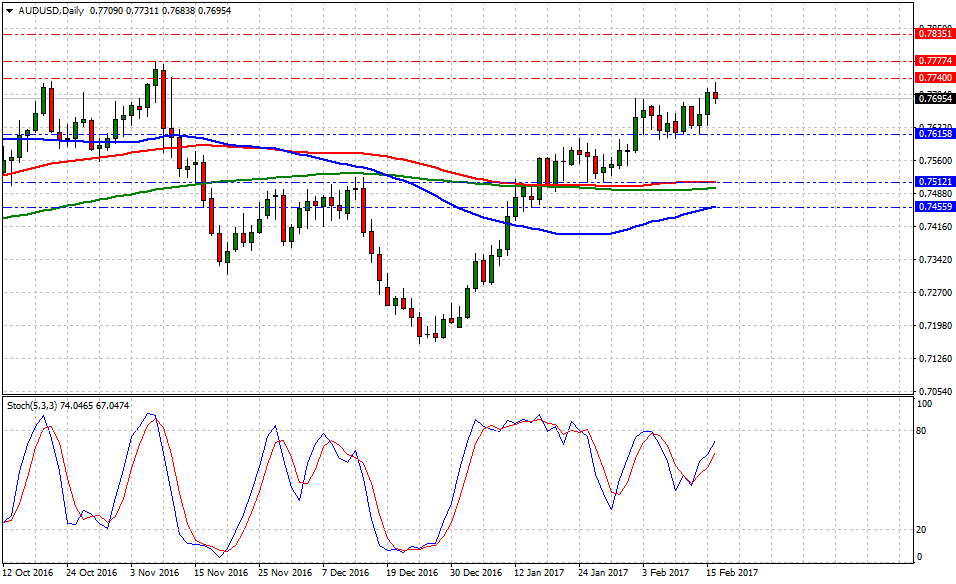

Currently, AUD/USD is trading at 0.7702, down -0.09% or (7)-pips on the day, having posted a daily high at 0.7731 and low at 0.7684.

The AU economy clocked yesterday mixed readings from the Employment Change and Unemployment Rate news releases as the ‘change’ printed ‘a better than expected’ at 13.5K or 3.5K above consensus 10K and (3.2K) lower from the previously revised figure at 16.3K. On the other hand, the ‘rate’ clocked a healthy 5.7% or 0.1% lower from consensus and previous.

Meanwhile, the US economic docket, the saga continued as Initial Jobless Claims clocked 239K ‘a better than expected’ figure against 245K consensus and slightly similar to 234K previous. Furthermore, Building Permits Change made an interesting statement at 4.6% from previously revised figure 1.3%.

When ‘Too Much’ makes Australia ‘mediocre.’

There is no country or region immune to a debt crisis and as David Taylor at ABC News reported, “According to research group Digital Finance Analytics, around 20% of “middle income” Australians have no room in their budget for unexpected expenses.”

Taylor further writes, “The latest Reserve Bank data shows household debt makes up 187% of total disposable income. That puts Australia right at the top, globally, regarding how much debt households are carrying. National Debt Helpline has also been overwhelmed with calls. In January last year around 11,000 people tried to get through to a counselor, and this January, that number shot up to 14,000 people. Financial Counselling Australia, which helps coordinate the helpline, said it experienced its highest-ever number of calls on January 17, with some callers distressed to the point of desperation.”

AUD/USD turns neutral, holding marginally above 0.7700 handle

Historical data available for traders and investors indicates during the last 7-weeks that AUD/USD pair, a commodity-linked currency, had the best trading day at +1.18% (Jan.17) or 89-pips, and the worst at -0.81% (Jan.18) or (61)-pips.

Technical levels to consider

In terms of technical levels, upside barriers are aligned at 0.7731 (high Feb.16), then at 0.7777 (high Nov.8) and above that at 0.7834 (high April.21). While supports are aligned at 0.7617 (low Feb.14), later at 0.7512 (100-DMA) and below that at 0.7459 (50-DMA). On the other hand, Stochastic Oscillator (5,3,3) seems to head north, for the time being. Therefore, there is evidence to expect further Aussie gains in the near term.

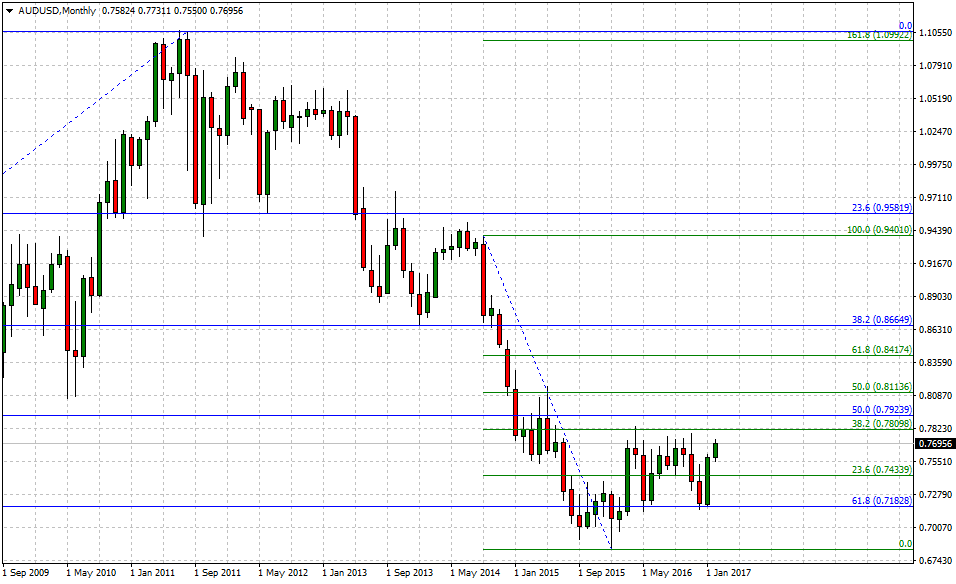

On the long term view, if 0.7834 (high April 2016) is in fact, a relevant top, then the upside is limited at 0.7809 (short-term 38.2% Fib). Furthermore, if the RBA has ‘no ammo’ nor solid reasons to increase rates in 2017, the interest rate advantage should decrease organically as the Federal Reserve continues increasing rates with 3-hikes in the next 16-months. To the downside, supports are aligned at 0.7433 (short-term 23.6% Fib), later at 0.7182 (reverse long-term 61.8% Fib) and below that back to 0.6826 (low Jan.2016).

AUD/USD erases gains near 0.70; US data ‘in line’ – Australia’s debt time bomb.

Source: AUD/USD erases gains near 0.70; US data ‘in line’ – Australia’s debt time bomb